ECB President Mario Draghi has announced a multi-billion-euro package, aimed at fending off deflation and stimulating growth.

He said the bank will buy €60 billion in assets a month from March until September 2016.

The money will include some from existing programmes.

Countries under a bailout programme, such as Greece, will be included but with some additional criteria.

The ECB is launching the programme with a view to buoying the flagging euro zone economy, where inflation has turned negative and - at minus 0.2% - is far below the central bank's target of just under 2%.

"Under this expanded programme the combined monthly purchases of public and private sector securities will amount to €60 billion," ECB President Mario Draghi said at a news conference.

"They are intended to be carried out until end-September 2016 and will in any case be conducted until we see a sustained adjustment in the path of inflation."

Mr Draghi said a "large majority" of the ECB council was in favour of launching the quantitative easing programme.

Earlier, the European Central Bank left its key interest steady at a record low of 0.05%.

Today's ECB decision to leave the cost of borrowing at record lows was widely expected after the ECB cut rates to rock-bottom levels last September and Mario Draghi then said they had hit "the lower bound".

What does quantitative easing mean?

The bank also kept the rate on bank overnight deposits at -0.2%, which means banks pay to place funds at the central bank, and held its marginal lending facility - or emergency overnight borrowing rate for banks - at 0.3%.

Mr Draghi told today's press conference that a "large majority" of the ECB's governing council were in favour of the QE launch to avert deflation.

The 25-strong body was "unanimous" on the principle that such a programme was a valid monetary policy tool, Draghi said. And a "large majority" was in favour of taking such measures "now"," he added.

Meanwhile, the ECB chief said that the ball was now in the court of governments to stop the euro zone from sliding into deflation after the ECB rolled out its biggest anti-crisis measure yet.

"It is now up to the governments and the EU Commission to act. Monetary policy can create the basis for growth, but for growth to pick up, investment is needed," he said.

Critics had expressed concern that European taxpayers would have to foot the bill of the QE programme, if any one country defaulted on its debt.

But the plan had been designed so that only 20% of those risks would be shared, with the other 80% to be shouldered by the national central banks of the countries concerned, Mr Draghi explained today.

Euro zone inflation could stay below zero in coming months

European Central Bank President Mario Draghi said that euro zone consumer prices could continue to fall over the next couple of months before picking up slowly towards the end of the year.

Euro zone consumer prices fell for the first time in more than five years in December after a significant drop in oil prices.

Policymakers are increasingly concerned that such a development could unhinge consumers' inflation expectations.

"Annual HICP inflation is expected to remain very low or negative in the months ahead," Draghi told today's news conference.

"Such low inflation rates are unavoidable in the short term given the recent very sharp fall in oil prices and assuming that no significant correction will take place in the next few months," he stated.

He said inflation was expected to increase gradually later in 2015 and in 2016 as the ECB's monetary policy measures support demand and assuming a gradual increase in oil prices.

The ECB said it expects inflation at 0.7% this year and at 1.3% in 2016 - far below its target of below but close to 2%.

The projections could, however, be revised downwards as they do not yet fully reflect the recent drop in oil prices.

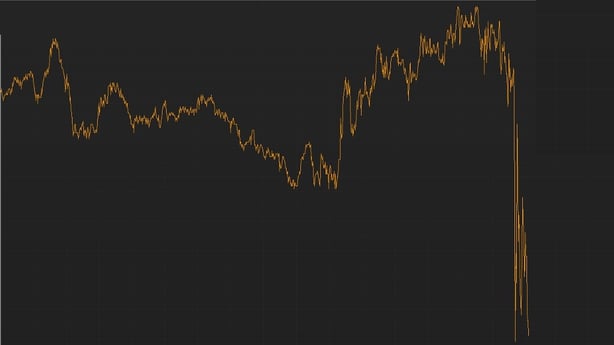

Meanwhile, the euro dipped against the dollar after the ECB revealed its bond-buying plan. It fell to $1.1513 in mid-afternoon deals from $1.1620 before Mr Draghi's announcement.

Anda sedang membaca artikel tentang

ECB to buy €60 billion a month in government bonds

Dengan url

http://newsdeadlineup.blogspot.com/2015/01/ecb-to-buy-a60-billion-month-in.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

ECB to buy €60 billion a month in government bonds

namun jangan lupa untuk meletakkan link

ECB to buy €60 billion a month in government bonds

sebagai sumbernya

0 komentar:

Posting Komentar